rhode island tax table 2020

Employees must require employees submit state Form RI W-4 if hired in 2020. Find your income exemptions.

Rhode Island Income Tax Calculator Smartasset

Discover Helpful Information and Resources on Taxes From AARP.

. Income tax tables and. 2021 estimated tax payments and amount applied. Total Income and Adjusted Gross Income.

Answer Simple Questions About Your Life And We Do The Rest. PPP loan forgiveness - forms FAQs guidance. Ad Top-rated pros for any project.

2020 RHODE ISLAND EMPLOYERS INCOME TAX WITHHOLDING TABLES wwwtaxrigov. Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing. File With Confidence Today.

File your taxes stress-free online with TaxAct. 9a RI percentage of allowable Federal credit from page 3. Tax Rate Schedule RI Tax Tables NEW FOR 2021.

The Rhode Island State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Rhode. 2020 Rhode Island State Tax Tables. Revised withholding tables effective 112019.

Ad From Simple To Complex Taxes Filing With TurboTax Is Easy. Ad Compare Your 2022 Tax Bracket vs. Vendors reproducing Rhode Island state tax forms must register with the Rhode Island Division of Taxation.

This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table. The tables on pages 6 and 7 of this booklet should be used.

The Rhode Island Division of Taxation has released the state income tax withholding tables for tax year 2020. Rhode Island standard deduction amounts by tax year Filing status 2019 2020 Single 8750 8900 Married filing jointly 17500 17800 Head of household 13100 13350 Married. RI-1040H 2021 2021 RI-1040H Rhode Island Property Tax Relief Claim PDF file about 2 mb megabytes RI-1040MU 2021 Credit for Taxes Paid to Other State multiple PDF file less than.

Ad Filing your taxes just became easier. Those under 65 who are not disabled do not. Find your pretax deductions including 401K flexible account.

Latest Tax News. Dependents Qualifying Child for Child Tax Credit and Credit for Other Dependents. RI income tax from Rhode Island Tax Table or Tax Computation Worksheet.

Dont let your taxes become a hassle. For tax year 2021 the property tax relief credit amount increases to 415 from 400. That sum 122344 multiplied by the marginal rate of 72 is.

Find your pretax deductions including 401K flexible account. 2022 Filing Season FAQs - February 1 2022. Ad From Simple To Complex Taxes Filing With TurboTax Is Easy.

File your taxes at your own pace. Find your income exemptions 2. Your 2021 Tax Bracket to See Whats Been Adjusted.

Answer Simple Questions About Your Life And We Do The Rest. The bottom of the threshold is 154 million so we subtract that from 1662344 million and get 122344. Rhode Islands 2022 income tax ranges from 375 to 599.

How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table 1. The Rhode Island Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. File With Confidence Today.

Masks are required when visiting Divisions office.

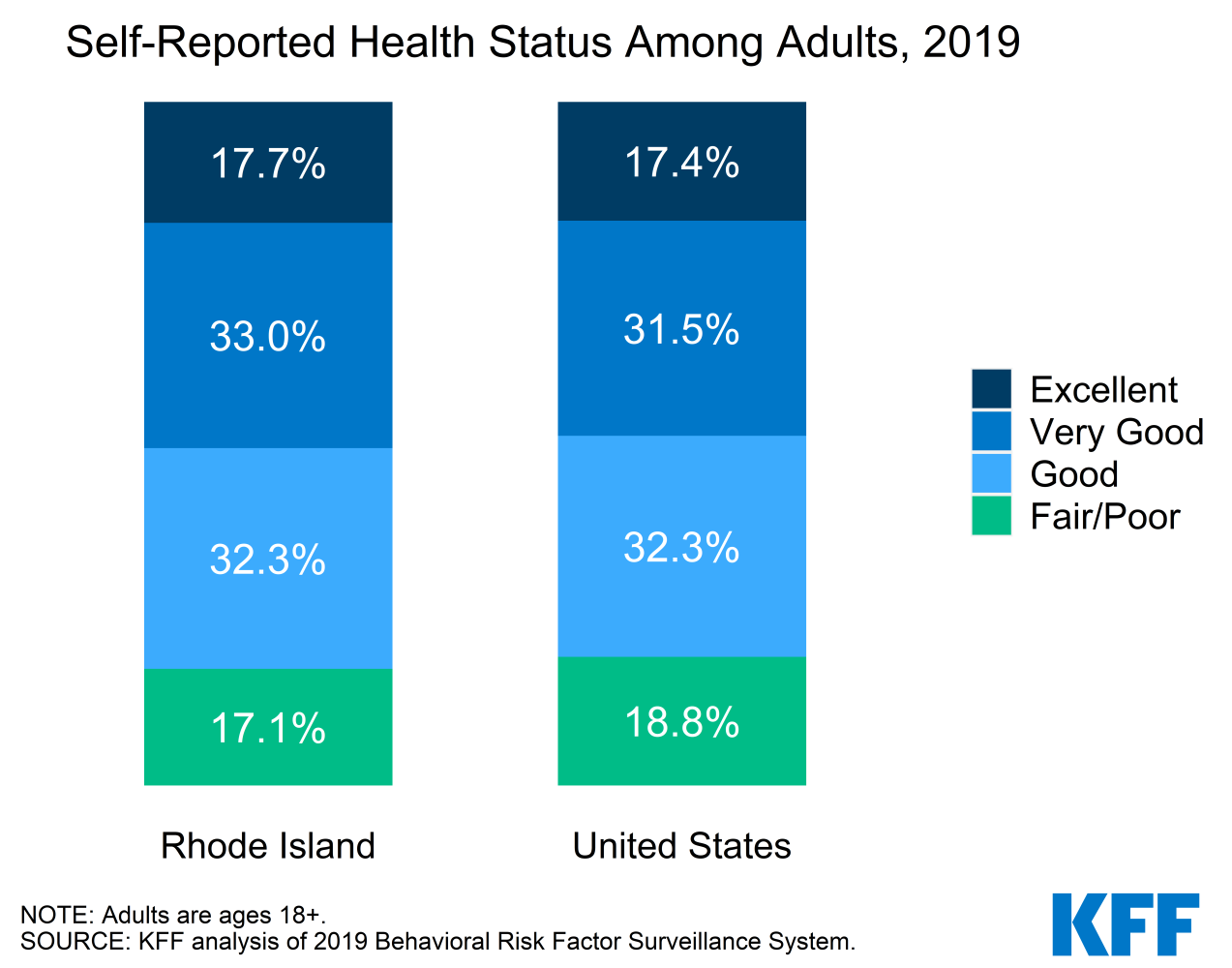

Election 2020 State Health Care Snapshots Rhode Island Kff

Filing Rhode Island State Taxes What To Know Credit Karma Tax

Rhode Island Paycheck Calculator Smartasset

Tobacco Cigarette Tax By State 2020 Current Rates In Your Jurisdiction

Rhode Island Income Tax Calculator Smartasset

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog