steamboat springs colorado sales tax rate

Steamboat Springs sales tax is levied on tangible personal property and taxable services that are purchased sold leased or rented within the City of Steamboat Springs. Ness license and the State of Colorado sales tax license.

Colorado Sales Tax Calculator Reverse Sales Dremployee

The US average is 73.

. Up to 24 cash back least 10000. The City of Steamboat Springs is a home rule municipality with its own Municipal Code collecting its own sales tax. Sales tax rate in Steamboat Springs Colorado is 3900.

And retail marijuana products are exempt from the 29 state tax. This includes the sales tax rates on the state county city and special levels. With local taxes the total sales tax rate is between 2.

The Steamboat Springs Colorado sales tax rate of 84 applies to the following two zip codes. Steamboat Springs is located within Routt County Colorado. The US average is 28555 a year.

2020 rates included for use while preparing your income tax deduction. Tax Rates City Sales Tax 40 School Tax 05 City of Steamboat Springs REMIT TO CITY 45 City Accommodations REMIT TO CITY 10 State of Colorado REMIT TO STATE 29 Routt County REMIT TO STATE 10 Total Combined Tax Rate 94 LMD Accommodations Tax REMIT TO STATE 20. Referendum 2B was passed by voters in November 2011 and expired Saturday.

The latest sales tax rates for cities starting with S in Colorado CO state. Colorado CO Sales Tax Rates by City S The state sales tax rate in Colorado is 2900. 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date.

Additional salesuse tax exemptions can be found at ColoradogovTax. The city has published the preliminary. 2020 rates included for use while preparing your income tax deduction.

The combined amount is 820 broken out as follows. How much do tax cuts cost. No credit card required.

The minimum combined 2022 sales tax rate for Steamboat Springs Colorado is. Steamboat Springs in Colorado has a tax rate of 84 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Steamboat Springs totaling 55. Condo located at 2300 Mount Werner 236 239 Cir Unit 235 Steamboat Springs CO 80487 on sale now for 229000.

The sales tax rate does. Sales Use Tax Sales tax is due at the time of titling. The sales and use tax rates within the city of Steamboat Springs will decrease by 25 percent effective today going from 475 percent to 45 percent.

The April 2022 sales taxes for the City of Steamboat Springs are 4. Live in Steamboat Springs. Sales and use tax.

The average cumulative sales tax rate in Steamboat Springs Colorado is 84. The Colorado sales tax rate is currently. What is the sales tax rate in Steamboat Springs Colorado.

- The Income Tax Rate for Steamboat Springs is 46. Create an Account - Increase your productivity customize your experience and engage in information you care about. If an exemption is.

The Steamboat Springs sales tax rate is 45 Steamboat Springs accommo-dations tax rate is 1 of the retail purchase price. The latest sales tax rate for Steamboat Springs CO. City Sales Tax.

80 higher compared to the April 2021 collections or an increase of 88 830. The Steamboat Springs Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Steamboat Springs Colorado in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Steamboat Springs Colorado. View 17 photos of this 2 bed 3 bath 1425 sqft.

Motor Vehicle Title Registration Resources. Buyer and seller both in Oak Creek. This is the total of state county and city sales tax rates.

Did South Dakota v. View details map and photos of this single family property with 4 bedrooms and 5 total baths. The County sales tax rate is.

The Colorado sales tax Service Fee rate also known as Vendors Fee is 00400 40 with a Cap of Exemptions County Municipality and Special District SalesUse Tax Exemptions Options. - Tax Rates can have a big impact when Comparing Cost of Living. Legal Address Tax Percentage.

An alternative sales tax rate of 84 applies in the tax region Steamboat Springs Local Marketing District which appertains to zip code 80488. Live in Routt County. Within Steamboat Springs there are around 2 zip codes with the most populous zip code being 80487.

Sales tax jurisdiction is County of Routt. The current tax rates are as follows. The Steamboat Springs sales tax rate is.

On November 3 2015 Colorado Springs voters approved a sales and use tax rate increase of 062 to fund road repair maintenance and improvements. For Sale - 36115 Quarry Ridge Rd Steamboat Springs CO - 3950000. The Steamboat Springs Colorado sales tax is 290 the same as the Colorado state sales taxWhile Colorado law allows municipalities to collect a local option sales tax of up to 42 Steamboat Springs does not currently collect a local sales tax.

This rate includes any state county city and local sales taxes. You can find more tax rates and allowances for Steamboat Springs and. April 2022 sales use and accommodation tax report.

Calculate rates Calculate rates Menu. Rates include state county and city taxes. In order to legally conduct sales within Steamboat Springs.

Tax relief costs in Colorado Springs vary significantly depending on the complexity of your situation the specific services required and the amount of back taxes you owe. The US average is 46. Buyer and seller both in Hayden.

Year - to - date sales tax collection is 30. Tax Jurisdiction Tax Rate State of Colorado 29 Routt County 10 City of Steamboat Springs 45 Total combined sales tax rate inside the City 84 Documentation provided outside City no permits or certificates 84 39 County building permits 74 29 City building permits 29 29 sales tax licenses 00 00 exemption certificates 00 00. Income and Salaries for Steamboat Springs.

April Preliminary Sales Tax Report. Free automated sales tax filing for small businesses for up to 60 days. 85 more than year to date through the same period.

- The average income of a Steamboat Springs resident is 36767 a year. That said most people pay 2000-7000 for professional tax breaks in Colorado Springs.

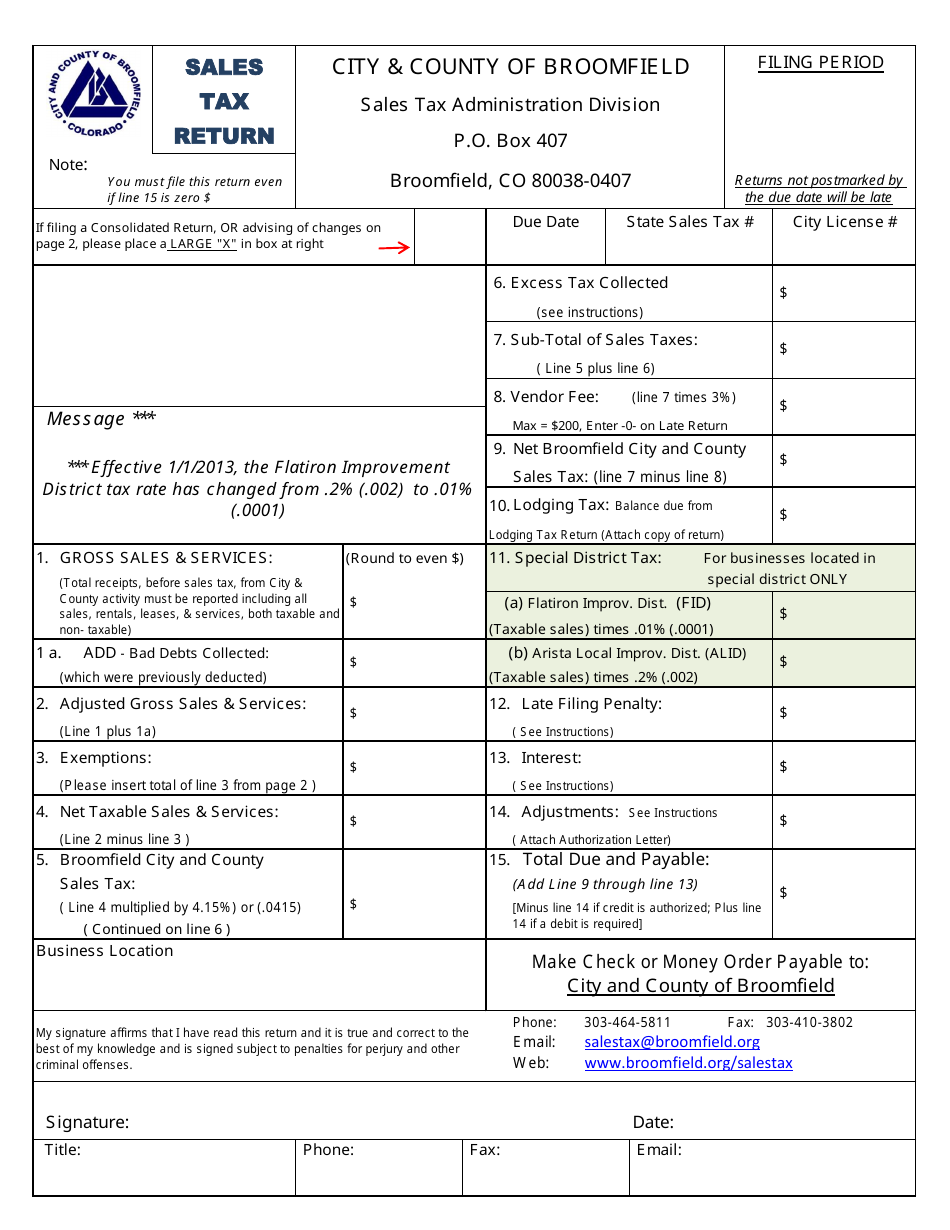

City And County Of Broomfield Colorado Sales Tax Return Form Download Printable Pdf Templateroller

Winter Park With Highest Sales Tax Rate In The State And Fraser See Increases In Sales Tax Revenue Skyhinews Com

File Sales Tax Online Department Of Revenue Taxation

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

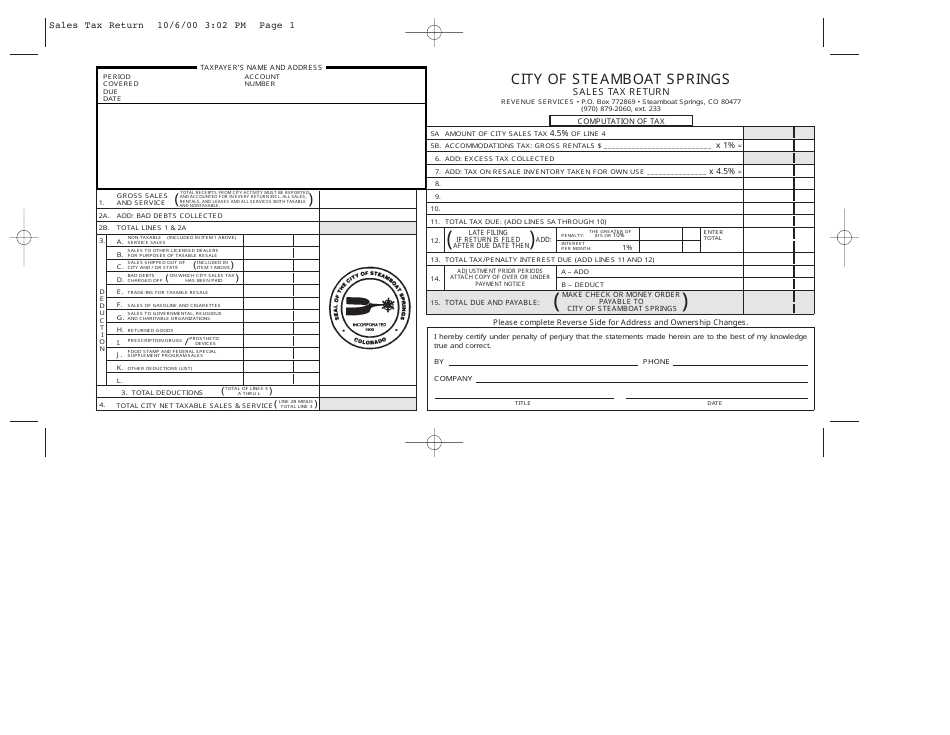

City Of Steamboat Springs Colorado Sales Tax Return Form Download Printable Pdf Templateroller

Colorado Sales Tax Rates By City

Sales Tax Worksheets Money Word Problems Skills Practice Word Problems

How S The Market Town Is Buzzing Real Estate Marketing Marketing How To Plan

Craig S 2022 Sales Taxes Up Through First Three Months Of The Year Craigdailypress Com

Colorado Sales Tax Rates By City County 2022

City Ends 2019 With Almost 8 More Sales Tax Collected Than Previous Year Steamboattoday Com

How S The Market Town Is Buzzing Real Estate Marketing Marketing How To Plan

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

2021 Sales Tax Reports Show Spending In Summit County Has Returned To Pre Pandemic Levels Summitdaily Com

Breckenridge S In Town Retailers Have Grown Sales More Than 12 Over Two Years Summitdaily Com

Alpenglow Village On The Horizon Apartment Communities Affordable Housing Village