new orleans sales tax calculator

The most populous parish. Orleans is located within Harlan County.

Louisiana Sales Tax Calculator Reverse Sales Dremployee

Our websites calculate the taxes due automatically.

. This takes into account the rates on the state level county level city level and special level. Louisiana was listed on Kiplingers 2011 10 tax-friendly. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred.

A full list of these can be found below. The average sales tax rate including local and state in the Bayou State is one of the highest in the country at about 955. It is designed to give you property tax estimates for.

Maximum Local Sales Tax. The current total local sales tax rate in New Orleans LA is 9450. Rates include state county and city taxes.

Our income tax calculator calculates your. The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax and 5 Orleans Parish sales tax. Click on links below to download tax forms relating to sales tax.

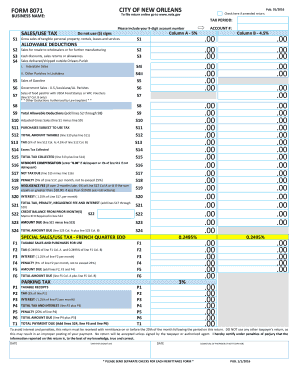

Sales Tax Forms. The average cumulative sales tax rate between all of them is 945. Form 8071 Effective Starting October 1 2021 Present.

This includes the rates on the state county city and special levels. The Louisiana sales tax rate is currently. The December 2020 total local sales tax rate was also 9450.

The minimum combined 2022 sales tax rate for New Orleans Louisiana is. 2020 rates included for use while preparing your income. You can find more tax.

The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in New. Depending on local municipalities the total tax rate can be as high as 1145. The most populous location in Orleans Parish Louisiana is New Orleans.

Use this New Orleans property tax calculator to estimate your annual property tax payment. October 6 2022 504-367-2333. The current total local sales tax rate in New Orleans LA is 9450.

Louisiana Documentation Fees. There is no applicable city tax or special tax. As we all know there are different sales tax rates from state to city to your area and everything combined is the.

Orleans Parish in Louisiana has a tax rate of 10 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Orleans Parish totaling 6. You do not have to calculate the amount of tax due. The Louisiana LA state sales tax rate is currently 445.

Average DMV fees in Louisiana on a new-car purchase add up to 49 1 which includes the title registration and plate fees shown above. Credit cards are accepted on the httpsservicesnolagov website only. Rates include state county and city taxes.

This is the total of state parish and city sales tax rates. The latest sales tax rates for cities starting with N in Louisiana LA state. Method to calculate Orleans sales tax in 2021.

4 beds 45 baths 3657 sq. 2321 State St New Orleans LA 70118 1250000 MLS 2365781 Gorgeous custom 1 year young stunner on this treelined uptown. Maximum Possible Sales Tax.

Louisiana State Sales Tax. The average cumulative sales tax rate in Orleans Nebraska is 55. Sales Tax Calculator New Orleans.

Average Local State Sales Tax. The average cumulative sales tax rate in the state of Louisiana is 916. Department of Finance Bureau of Revenue - Sales Tax 1300 Perdido St RM 1W15 New Orleans LA 70112.

504 658-1606 For full.

New Orleans Louisiana S Sales Tax Rate Is 9 45

Louisiana Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax Calculator And Rate Lookup Tool Avalara

Sales Tax Calculator Check Your State Sales Tax Rate

California Sales Tax Rate Rates Calculator Avalara

Louisiana Sales Tax Is Soaring Through The Roof Truth In Politics

Illinois Sales Tax Guide For Businesses

Michigan Sales Tax Rate Rates Calculator Avalara

Sales Taxes In The United States Wikipedia

8071 New Orleans Form Fill Out And Sign Printable Pdf Template Signnow

Sales Taxes In The United States Wikiwand

California Sales Tax Rates By City County 2022

What Are The Taxes On Selling A House In New York

Transfer Tax Calculator 2022 For All 50 States

Sales Tax Rates Louisiana Department Of Revenue

Pelican Institute Responds To Passage Of Sales Tax And Special Session Conclusion Biz New Orleans

Why Are Property Taxes Higher As A Percentage In Austin Than They Are Even In Seattle Quora